After just over a year at the helm, Brian Humphries has unveiled a new strategic direction for Cognizant. The big headline from this change is the desire to shift Cognizant’s perception from an outsourcing provider to a “preeminent technology services brand.” Perhaps the best demonstration of how it will change this desire into reality is its Microsoft Business Group investments.

Historically, the offshore services firms were both accused and praised for emulating Accenture. The holy grail for the services industry, being the fusion of the Accenture reputation for quality and innovation with the economics of a traditional offshore outsourcer. Under Brian Humphries, Cognizant has undoubtedly taken a leaf out of the Accenture playbook focusing on building relevant skills through acquisition – with a savvy focus on building out a stronger cloud business.

Over the last 18 months, Cognizant has bolstered its capabilities by acquiring dozens of firms. In many respects, the firm has spent a larger proportion of its war chest on building out application development and digital engineering capabilities – an area Cognizant’s leadership team rightly see strong future growth, and crucially a market it’s unique model and structure can gain real traction in. But the firm has shifted its investment profile considerably since the Covid-19 pandemic, instead piling cash into firms that accentuate Cognizant’s already developed cloud services business – with a particular emphasis on Azure.

To start with, Cognizant bought up New Signature – an Azure cloud consultancy with 500 professionals based in key markets including the UK and US – as a resource injection into the firm’s freshly announced Microsoft Business Group. New Signature has a strong track record of delivering enterprise-grade cloud transformation programs using the full suite of Microsoft’s business solutions to help clients including Virgin Atlantic, Hersheys, and the NHS. In a signal to the market that the spending spree isn’t over, Cognizant recently announced the acquisition of 10th Magnitude, another Microsoft focused services firm. 10th Magnitude brings Cognizant another 150 brains to support Cognizant’s cloud ambitions.

With enterprises embracing the cloud, a big bet on Azure is a smart move

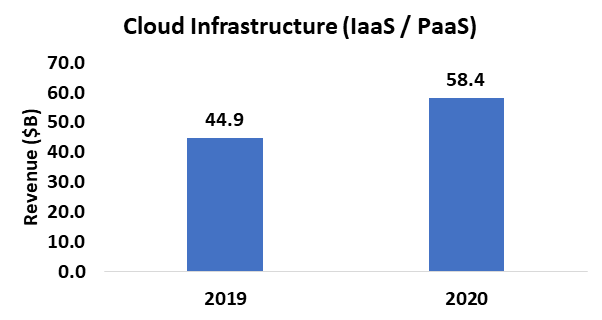

As enterprises aggressively embrace the cloud following the Covic-19 pandemic, we can expect to see strong revenues from the hyperscale cloud giants. Our estimates suggest the three largest public cloud firms (Azure, AWS, Google Cloud Platform) are likely to see a 30% increase in revenues from 2019 to 2020 alone. We expect combined revenue will grow from $45bn to $58bn in 2020 (see Exhibit 1). However, cloud transformation programs are complex and labor-intensive, and much of this growth will inevitably feed into the services and solutions of the broader IT Services ecosystem.

Exhibit 1 – Hyperscale Cloud Revenue

Source: Market Prescience Analysis of Company Financials. Note this is the combined estimated revenue for AWS/Google/Azure IaaS/PaaS services

All of these factors combined, Cognizant’s investment in building out cloud capabilities, is a shrewd move. Appetite for the broad spectrum of cloud capabilities needed to support their new post-Covid operating models will push infrastructure modernization and enterprise re-platforming to the top of C-Suite priority lists.

Similarly, focusing on Azure taps into a rapidly evolving market trends – as enterprises look to find public cloud partners they trust and ties in more directly with their existing systems. Compared to the exponential growth of AWS, Microsoft’s cloud business looks somewhat stagnant. However, the broader capabilities of Microsoft’s business suite are looking increasingly attractive to enterprises. Foremost, because many of them are familiar with Microsoft enterprise technologies and have existing arrangements and contracts in place. But now other factors are pushing Microsoft ahead of its fiercest competitors.

AWS has come under attack in recent months for its lock-in reliant business model and uncompetitive pricing structures. And while Google is more focused on growing GCP than ever before, it still trails it’s larger peers by a significant margin. Meanwhile, over years of delivery, Microsoft has built up considerable enterprise trust – buoyed significantly in recent months as enterprises race to deploy O365 and Teams to keep their businesses running through the Covid-19 pandemic.

However, while Cognizant’s move to exploit this shifting landscape adds up, it is not the only firm in recent years to lean further into a Microsoft partnership. Accenture’s Avanade partnership and DXC’s all-powerful Microsoft business team are just two examples where Cognizant is playing catch-up with competitors rather than leading the charge.

Even with some competitors ahead of the curve, the insatiable demand for cloud services puts the seal of approval on Cognizant’s investments

The more optimistic reality is playing catch-up or leading the charge make relatively little difference in a market where demand far outstrips supply. Azure talent is tough to find at scale – so Cognizant’s willingness to bring in close to 1000 professionals through acquisition puts it in a stronger position to service rapidly growing demand than competitors looking to build talent organically. Moreover, with a commitment to spend millions on growing their new Microsoft Business Group, it is unlikely we have seen the last acquisition from Cognizant. With a few more investments bringing talent-at-scale and focused localized delivery – Cognizant can quickly become a must-have on CIOs cloud transformation shortlists.

Cognizant’s aim is to be a preeminent services player across the technology frontier – starting with crucial ecosystem relationships in key technology areas like the cloud is a sound way to demonstrate you mean business.