It’s hard to think of a business technology that’s caught more focus since the COVID-19 pandemic than Cloud. Even before the pandemic, enterprises across the globe raced ahead with ambitious cloud migration programs, with many looking to the technology as the salvation to their rigid and inflexible infrastructure. And with the rush to remote working environments and the need to adopt new business models, the appetite for enterprise cloud increased dramatically.

It’s no surprise then that Cloud continues to be an area of considerable marketing investment from the leading services firms. The topic remains one of the most heavily marketed, but in a hectic and chaotic space, the messaging from several firms is simply falling through the cracks. While for others, well managed thought leadership campaigns are seeing them dominate social media channels.

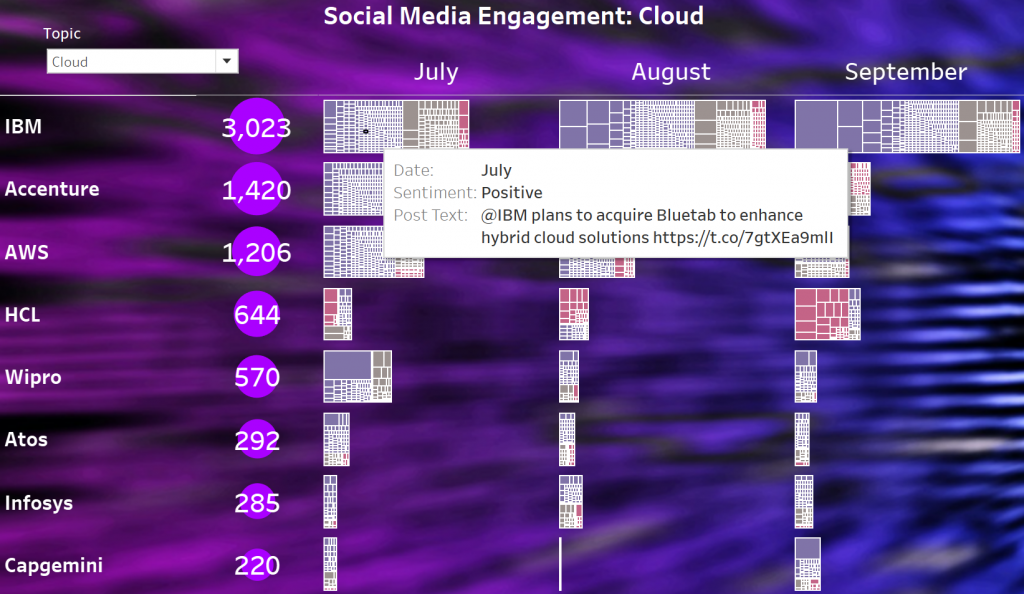

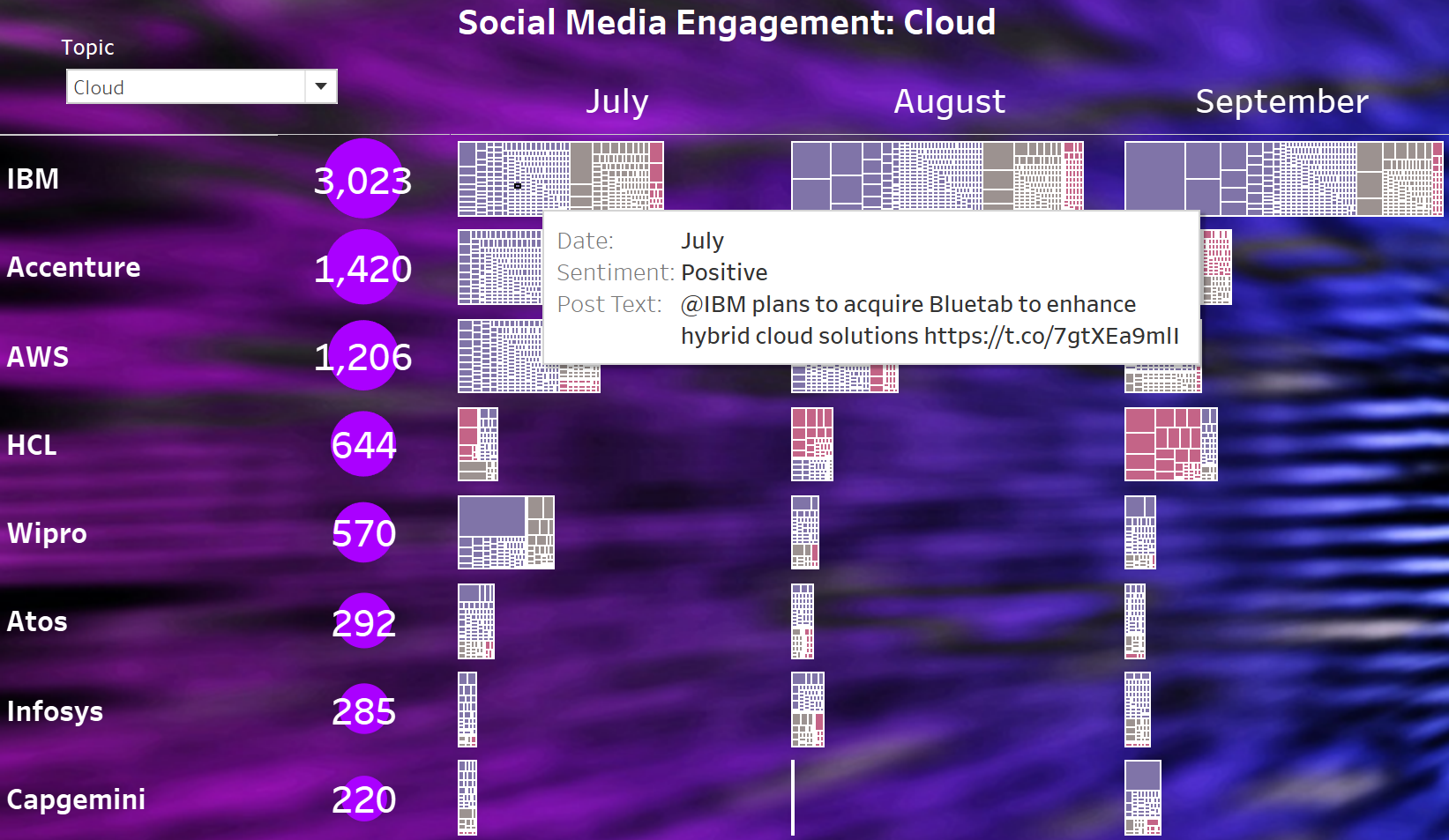

IBM and Accenture reign supreme - but several cloud challengers are lining up to attack

Looking at the chart, there’s an obvious winner. IBM enjoys more than double the posts and engagements of its nearest competitor. And, for the most part, the engagement is positive. Over the last couple of months, IBM has pounded the social universe with a plethora of webinars, pushing new capabilities in the cloud space – with particular traction in the cybersecurity space courtesy of several articles in popular publications. The firm also benefited from a slew of partnership announcements.

There are some negative posts, however, which dull the shining light of IBM somewhat. The firm took a hit by being tied to some social communications centred on government concern around cloud security and some candid feedback from enterprises doubting the firm’s hybrid credentials compared to other hyperscalers.

And it’s this point which we need to focus on a little more – IBM is somewhat hard to compare to several of its competitors. Plotting the firm next to AWS seems unfair given IBM’s larger services business. And for the opposite reason measuring the firm next to Accenture or HCL ignores the firms large hyperscale business. In any case, the firm’s marketing and positioning prowess in the space is laudable, particularly as shadows over the firm’s future – and its Kyndryl spinoff – are seen relatively little in public discourse.

Snapping at the heels of IBM is Accenture and, to a lesser extent, AWS. These firms effectively represent the challenge of measuring the leading cloud giants in the space, with the former the largest services firm in the market, and the latter the largest hyperscaler.

Much like IBM, Accenture’s social impact is largely positive. The firm has seen strong traction marketing virtual events and highlighting the thought leadership from Accenture’s cloud experts. The firm also ran a large survey which has provided the marketing machine with solid content to push into the market. Indeed, what little neutral or negative sentiment in there is in the market stems from this survey and the concerning results, rather than specific criticism of Accenture.

AWS is a tougher nut to crack. In theory, the firm should have far more engagement – it’s the most prominent and best-known firm in the space. Unlike its competitors, it can dedicate most marketing investment and resources to the space, rather than spreading it across diverse service lines. To an extent, most of the engagement appears organic rather than led by specific thought leadership. The caveat being that much of the organic engagement also includes references to the other hyperscalers – notably Microsoft and Google. Aside from this, the firm’s social impact benefits the most from its ecosystem – with much of the engagement oriented around ecosystem partners, such as SIs and trainers publicising success stories.

HCL and Wipro Form First Wave

These three firms – IBM, Accenture, and AWS – make up the top three and hoover up a large portion of the overall engagement in the space. But following them is a pack of hungry services firms with growing traction in the space. One of the big surprises is HCL, which leads the pack below the top three. The firm is pumping thought leadership into the space, alongside marketing the firm’s highly practical solutions – with particular emphasis on enabling cloud-native development. It is interesting that the sentiment analyser is picking up some high impact negative posts for HCL, however, the negative sentiment is not aimed at HCL, but a challenge for the technology.

Just below HCL is Wipro, much of the firm’s engagement is packed into the first half of the quarter which saw the announcement of Fullstride – a considerable $1bn investment in the firms cloud capabilities. Aside from this major announcement, the firm has enjoyed engagement from several industry-focused case studies and announcements focused on hyperscale partners. If Wipro can maintain the levels of engagement achieved in July they can leap frog HCL and challenge AWS.

Atos, Infosys and Capgemini lead the Fast Followers

Below these two standout performers, there is a large pack made up of the largest IT services giants – specifically Atos, Infosys, and Capgemini. Who have each seen engagement of between 200 and 300 posts. For Atos, the standout engagements have fallen around the firm’s award from Google Cloud as the Global Social Impact partner of the year. Infosys has developed solid thought leadership through its Cloud Radar 2021 study which has seen decent traction. And Capgemini has continued to push messaging around the Intelligent industry – pulling the importance of Cloud into its core messaging.

As enterprise appetite for Cloud evolves, we can expect much more emphasis from the leading IT Services giants and their hyperscale partners on thought leadership and marketing as the battle to capture executive mindshare. For many, this will mean a significant ramp-up in investment – but caution is required. Many in the space have fallen into the trap of throwing money at the topic with little clear understanding of how executives will engage in the topic. As the social impact rise of firm’s like HCL proves – quality is far more important than quantity.

Please reach out to us if you’d like to know more. We can help your organization look at their social media engagement using our tools and we would be happy to talk you through this.