The first of the IT Service companies results of the Q3 2020 (calendar) season are out, and they indicate the IT Services players have been resilient in the face of the challenge set by COVID. The global players have taken the appropriate action to ensure margins remain strong, despite slower growth rates. Infosys has been particularly strong, continuing its financial renaissance even during this period.

This analysis is based on the financial results of a group of five (Accenture, IBM, TCS, Infosys & Wipro) IT Services companies – we call them the early birds. Because they typically announce their quarterly results first, an analysis of these results can provide an early indication of what the rest of the industry is likely to report for the quarter. Given the impact of COVID on the results, it’s essential to examine these results to see how the IT services industry is impacted overall.

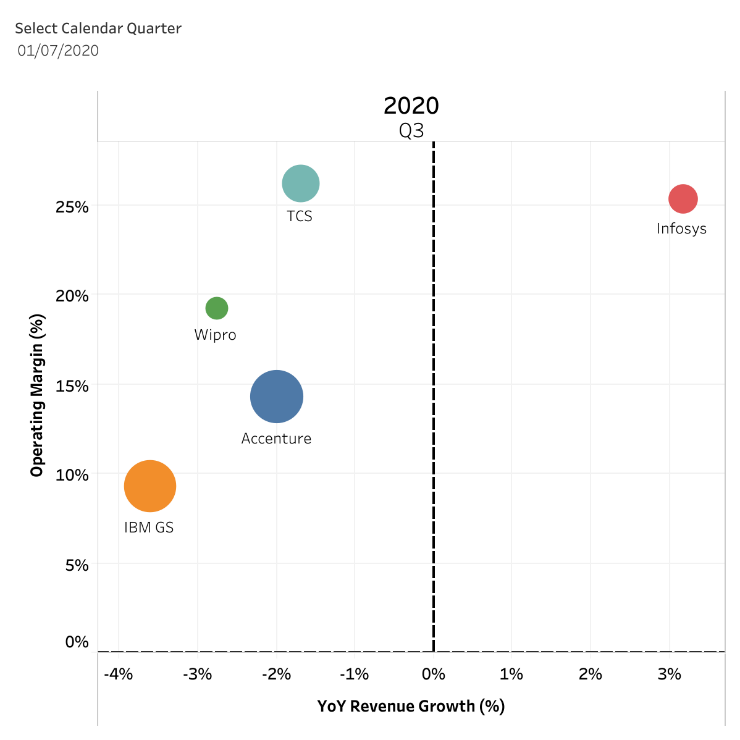

Exhibit 1 shows the quarterly year-on-year (YoY) revenue growth and operating margin performance for these service providers. The size of the bubble indicates the size of revenue.

Exhibit 1 – Financial Performance of the Early Bird Service Providers

[iframe width=”600″ height=”600″ seamless frameborder=”0″ scrolling=”no” src=”https://public.tableau.com/views/EarlyBirdRev2/SupplierPerf?:language=en-GB&:display_count=y&:origin=viz_share_link&:showVizHome=no&:embed=true”]

Source: Market Prescience Analysis of Company Financials. Please note this is an interactive chart so you can see the progression for these providers for previous quarters – use the slider at the top of the chart.

All of the providers’ revenues declined YoY in Q3, apart from Infosys. Although these declines were half those seen in Q2, which indicates the impact of COVID on IT Services may be shorter term than we feared. With customers continuing to spend as we go through the crisis.

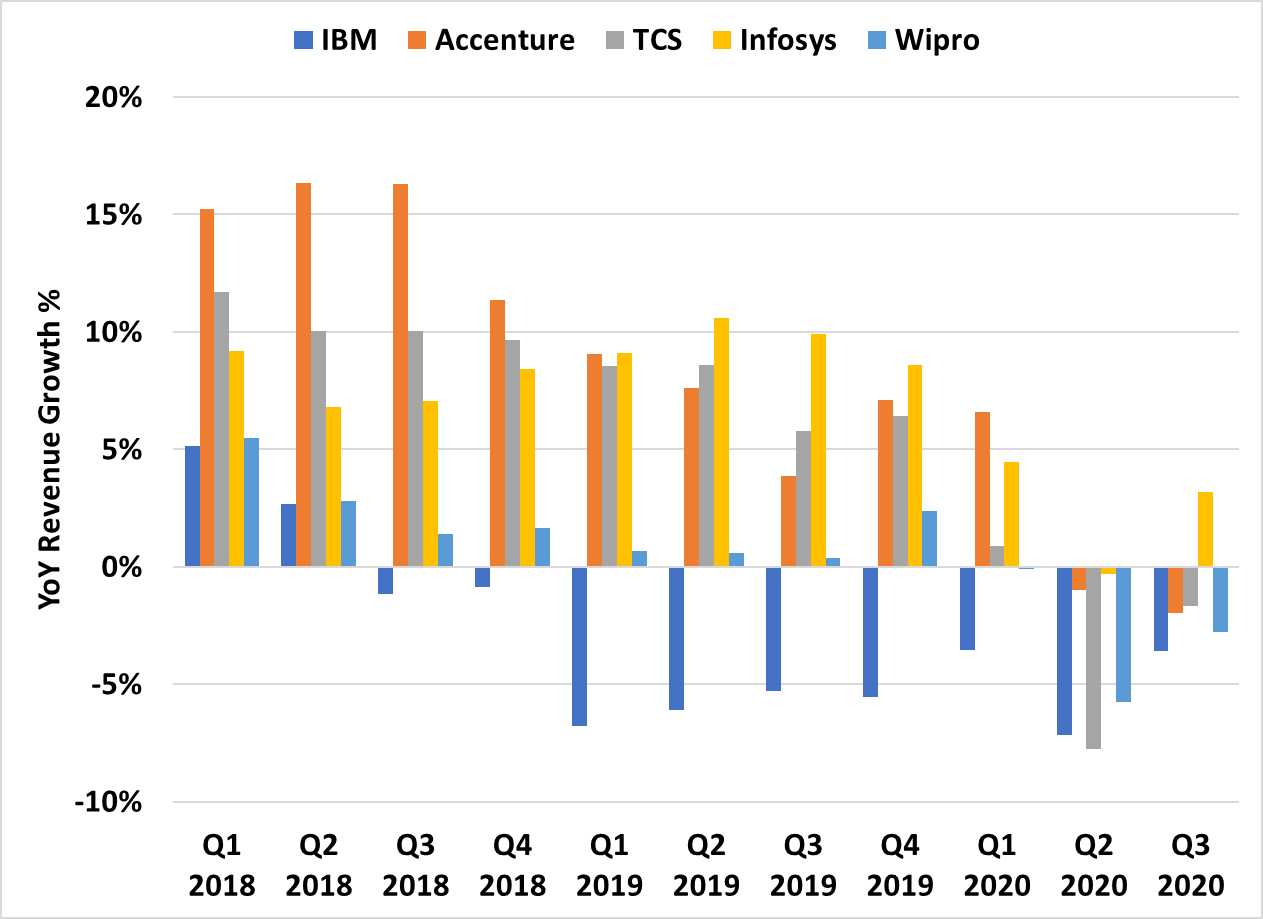

You can see the quarterly comparison of the growth rates in Exhibit 2 (and by using the slider on Exhibit 1).

Exhibit 2 – Revenue Growth by Quarter for the Early Bird Service Providers

Source: Market Prescience Analysis of Company Financials.

As you can see in the chart above, although Q3 revenues declined for most of the service providers, growth rates improved significantly compared with Q2 – with these service providers managing to find a way to drive additional business and support clients remotely. Although there is likely to be a longer-term resultant economic impact of COVID, IT services are an integral part of most organizations’ plans. It is hard to scale back, particularly as customers shift to digital channels.

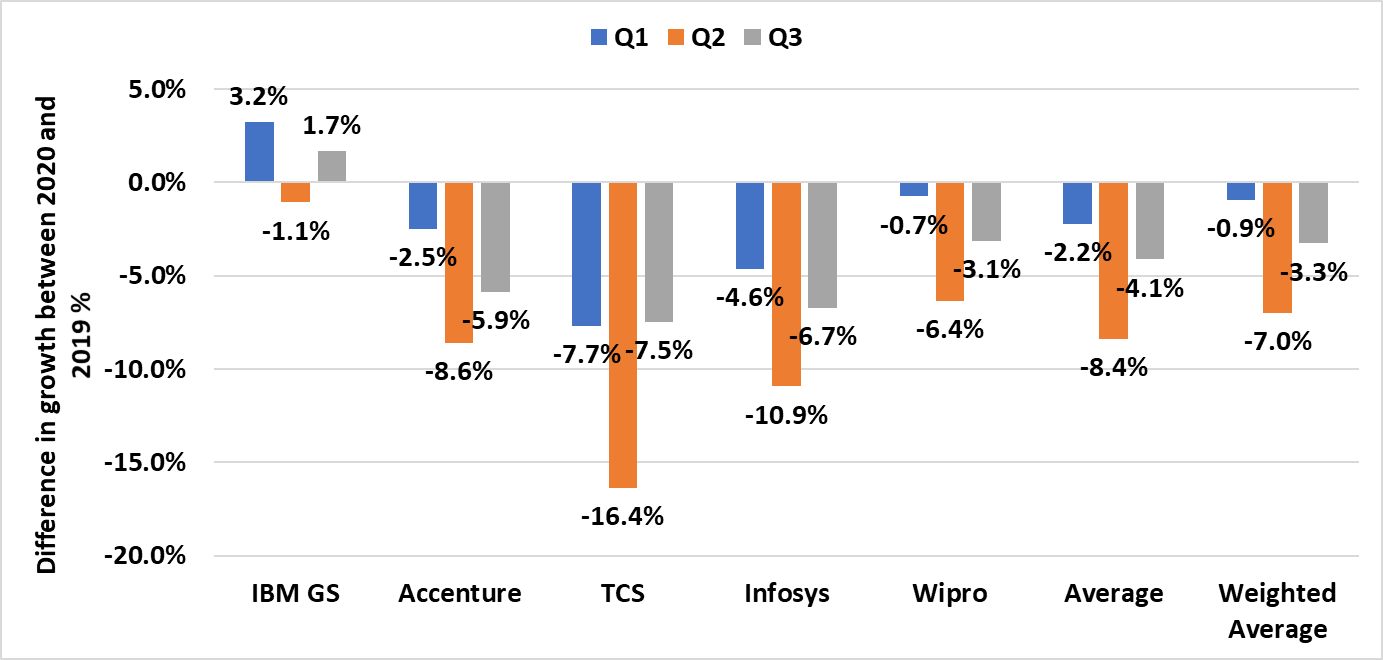

To figure out the scale of the impact of COVID, Exhibit 3 compares the growth rates for the first three quarters of this year against growth for the first three quarters of 2019. So if Q3 2019 revenue growth was 8% and Q3 2020 is 0%, the difference would be -8%. Although there are many other factors at play, it gives an idea of the scale of the impact from COVID.

Exhibit 3 – Difference between Growth Rates 2020 and 2019

Source: Market Prescience Analysis of Company Financials

Looking at the impact of COVID, Q2 saw the most significant change with an average difference of -8.4%. But performance swung back across the board with an average of 4.1% for Q3 2020. It is indicating that the impact of COVID may be shallower than expected. Although this may not account for longer-term economic consequences, it does show the IT Services market is generally resilient.

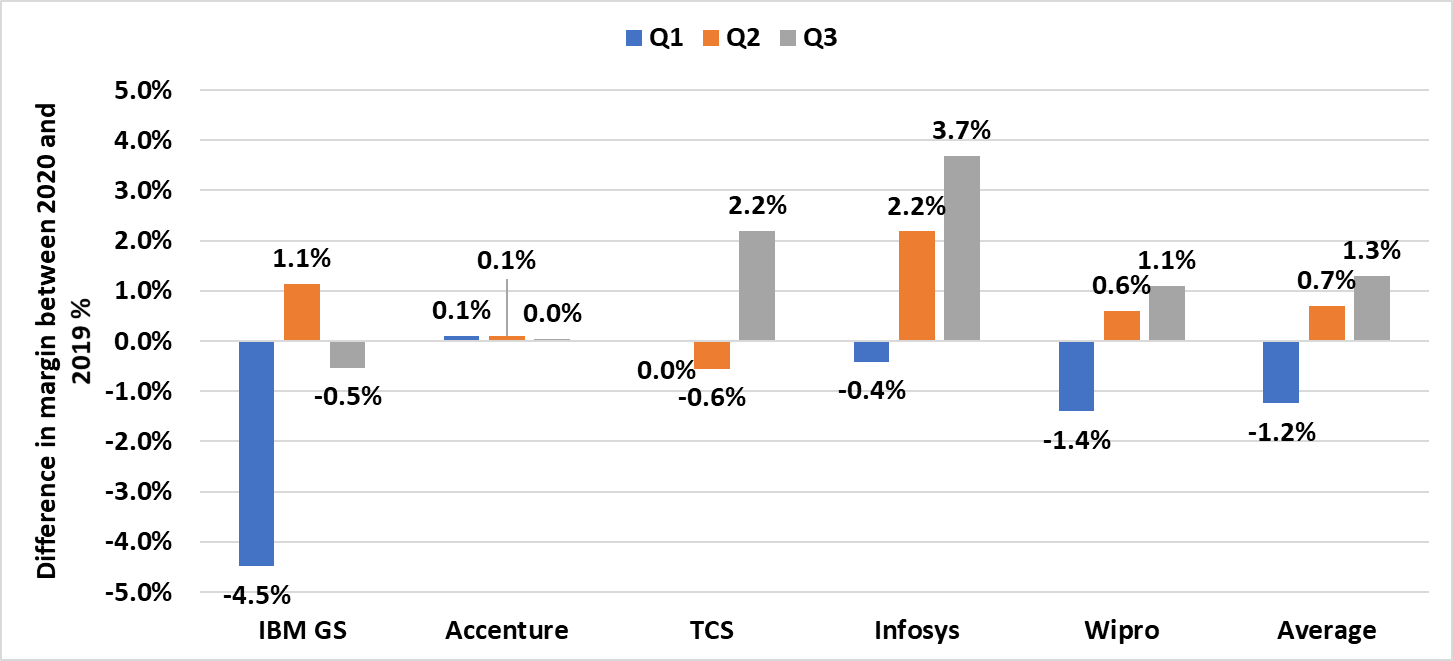

This is further evidenced by the data in Exhibit 4, which compares the impact on operating margins in the same way.

Exhibit 4 – Difference between Operating Margin 2020 and 2019

Source: Market Prescience Analysis of Company Financials

Margins across the board have improved for the services players from this time last year. Partly this is due to the early intervention by these organizations to control costs when it was clear revenue would be impacted. Plus, a significant line of expense for many of these organizations is travel, so a substantial reduction in travel costs has helped keep margins at bay. Although it is also a testament to how agile these large IT firms have become, taking less than a quarter to scale down in response to this crisis.

Based on these results, the IT Services market is likely to be impacted less than feared. With the services providers mostly bouncing back in Q3. Although it is still early, both in this quarter’s results season and in the crisis, this should give some optimism that growth may return to the market overall over the next two quarters. The operational strength of the leading service providers is resilient to withstand what is to come.

We will be looking at all of the results for the major IT Services players as they come in to see how indicative this has been and whether there has been a different impact on the other service providers. It will be interesting to see whether the European centric providers have fared any differently and whether the other offshore providers, HCL and Cognizant, are holding up as well as their compatriots.