The Q3 2020 results session has shown how resilient the IT Service market has been to COVID. In particular, the TWITCH providers (Tech Mahindra, Wipro, Infosys, TCS, Cognizant and HCL Technologies), who all performed better than Q2, showed remarkable ability to respond quickly to the pandemic.

Exhibit 1 and 2 – show the growth and operating margin performance of these organizations over the past five quarters. You can switch between operating margin and year-on-year revenue growth using the drop box at the top.

Exhibit 1 shows growth or margin as a line chart.

[iframe width=”720″ height=”860″ seamless frameborder=”0″ scrolling=”no” src=” https://public.tableau.com/views/EarlyBirdRev2/TWITCHGorMline?:language=en-GB&:display_count=y&publish=yes&:origin=viz_share_link&:showVizHome=no&:embed=true”]

Source: Market Prescience Analysis of Company Financials. All quarters are as close to the calendar quarter as possible.

It’s important to point out that some HCL growth in 2019 was because it acquired some of IBM’s software business at the end of 2018. Otherwise, someone could interpret the big change in growth from 2019 to 2020 more negatively. Looking beyond this, the pattern for all of the players is similar, but from different starting positions. TCS took the biggest hit in Q2 2020 but recovered more in Q3. HCL’s delta was large, but the IBM deal accentuated this. Wipro’s delta was smaller but from a worse base. Cognizant, Tech Mahindra, and Infosys followed a similar pattern between them.

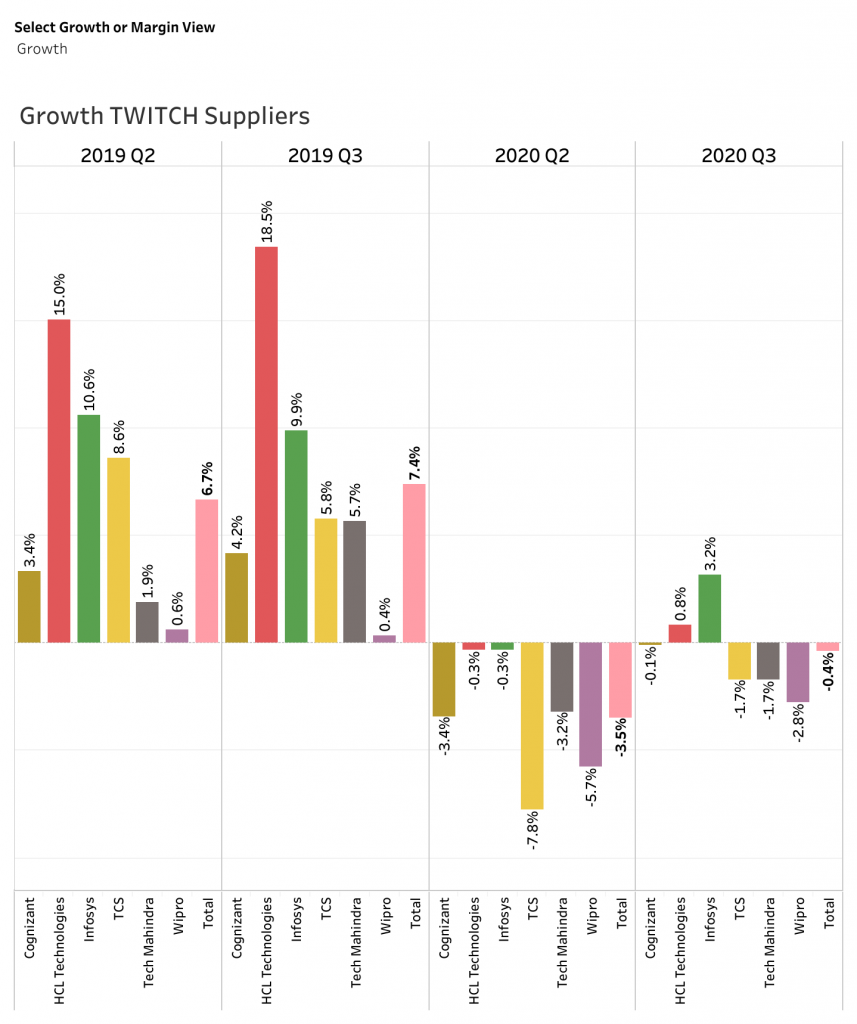

Exhibit 2 shows growth or margin as a bar chart and includes a “total,” which is the average performance for the group for Q2 and Q3 for 2019 and 2020.

[iframe width=”720″ height=”860″ seamless frameborder=”0″ scrolling=”no” src=” https://public.tableau.com/views/EarlyBirdRev2/TWITCHGorM?:language=en-GB&:display_count=y&publish=yes&:origin=viz_share_link&:showVizHome=no&:embed=true”]

Source: Market Prescience Analysis of Company Financials. Market Prescience Analysis of Company Financials. All quarters are as close to the calendar quarter as possible.

The final bar on the right of the chart showing the total or average performance – if you compare the Q3 2020 number with Q3 2019, you can get a rough idea of the impact of COVID. The only issue is HCL, who had a growth uplift in 2019 for its IBM deal, which skews the average a couple of percent upward. Correcting for this, the average growth was around the 6% mark. So it is likely that COVID impacted the TWITCH players by around 5.5%-6% in Q3 and 8-8.5% for Q2.

Exhibit 3 shows operating margin, revenue growth, and revenue (the size of the bubble).

[iframe width=”600″ height=”600″ seamless frameborder=”0″ scrolling=”no” src=”https://public.tableau.com/views/EarlyBirdRev2/TWITCHPerformance?:language=en-GB&:display_count=y&:origin=viz_share_link&:showVizHome=no&:embed=true”]

Source: Market Prescience Analysis of Company Financials. Market Prescience Analysis of Company Financials. All quarters are as close to the calendar quarter as possible.

Apologies for the data overload – but I think the charts tell a good story – particularly as you compare the progression from Q1, Q2 to Q3 with all of the providers maintaining margin well and improving year on year growth into Q3. The providers shifting all shifted well to work at home models, providing good support to clients and even accelerating transformation work in key areas like cloud. In some ways, these performances are in themselves a compelling case study in using technology to drive corporate agility.

But what does this say about the market ahead?

These results indicate that the short-term impact of COVID on the IT Services market is significant but less severe than initially feared. Although the caveat is that we are yet to have visibility on the longer-term impact fueled by the more profound economic stress COVID is likely to cause.

The most significant change is around the perception of technology, mainly digital. I used to talk about digital annexing IT – which meant that the term digital was just replacing the word IT. If you wanted to get backing for an IT project, you called it digital, essentially becoming a euphemism for “good” IT, at least for many non or less technical people. The sense that digital was becoming for many meaningless or at least definition-less had led to slowing down and resistance to some technology adoption. This occurred mainly when the business value of adoption was unclear, especially when past projects had failed to deliver.

So the big question is whether trust in technology has been changed because of COVID, and is this change permanent? Are companies’ senior management willing to take bolder and broader steps in their digital and cloud journeys? Will this prompt real change?

With this in mind, there were a couple of important thoughts from the detail behind the financial results:

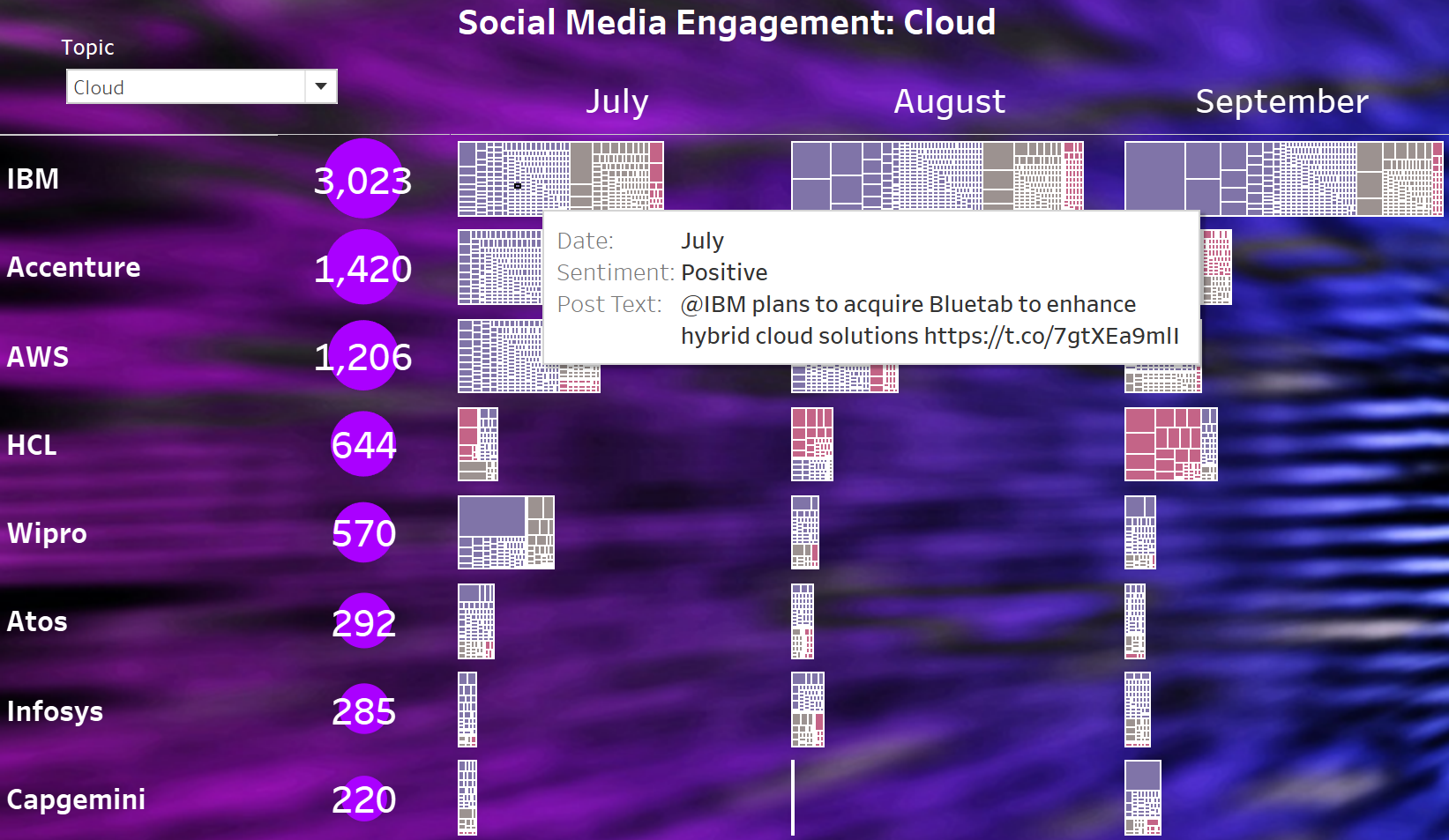

- Decision making has not slowed across the IT Services spectrum. Decision cycles for transformation work that strengthen the organization’s digital foundations have accelerated for the lead players. Services affected by this increased speed adoption are ones that increase operational resilience, drive customer intimacy, and help drive employee engagement. These include hybrid cloud transformation and application re-platforming activities like IT application modernization.

- Investment is focused on the next level of digital, new geographic coverage, and strengthening ecosystem approaches, particularly with applications and cloud partners. Many of the leaders mentioned increasing IP and skills investment that built out AI, machine learning, and analytics capabilities. However, there was an increased focus on localization and building geographic presence; customers expect more presence and diversity of operations. Finally, looking to build skills and practices that enhance offerings around third-party platforms – like Workday and Salesforce, and with cloud partners like AWS, Google, and Microsoft.

So rather than delaying decisions COVID has helped to speed up the process. For example, where there was a five-year plan to remove technology debt gradually, the program would be accelerated to bring about the majority of the change within the next 12 months.

While we haven’t seen all of the Q3 results yet, the theme so far is Q3 2020 is better than Q2. The impact of COVID has been considerable, maybe as much as 6% in revenue terms. Still, the agility of the IT services players and the importance of what they do for their customers is ensuring the market continues to look forward.