On 8th October 2020, IBM announced its plan to divest the managed infrastructure services unit of its Global Technology Services business, a move that has been rumored for a while. The initial reaction from the market and commentators seems to be pretty positive for IBM. My concern is what it does for IBM as a services firm. While it might allow the firm to focus on growth areas AI/ML and hybrid cloud offerings, it decimates its services business moving it to the number 3 position from its traditional number 1 spot in the IT Services market.

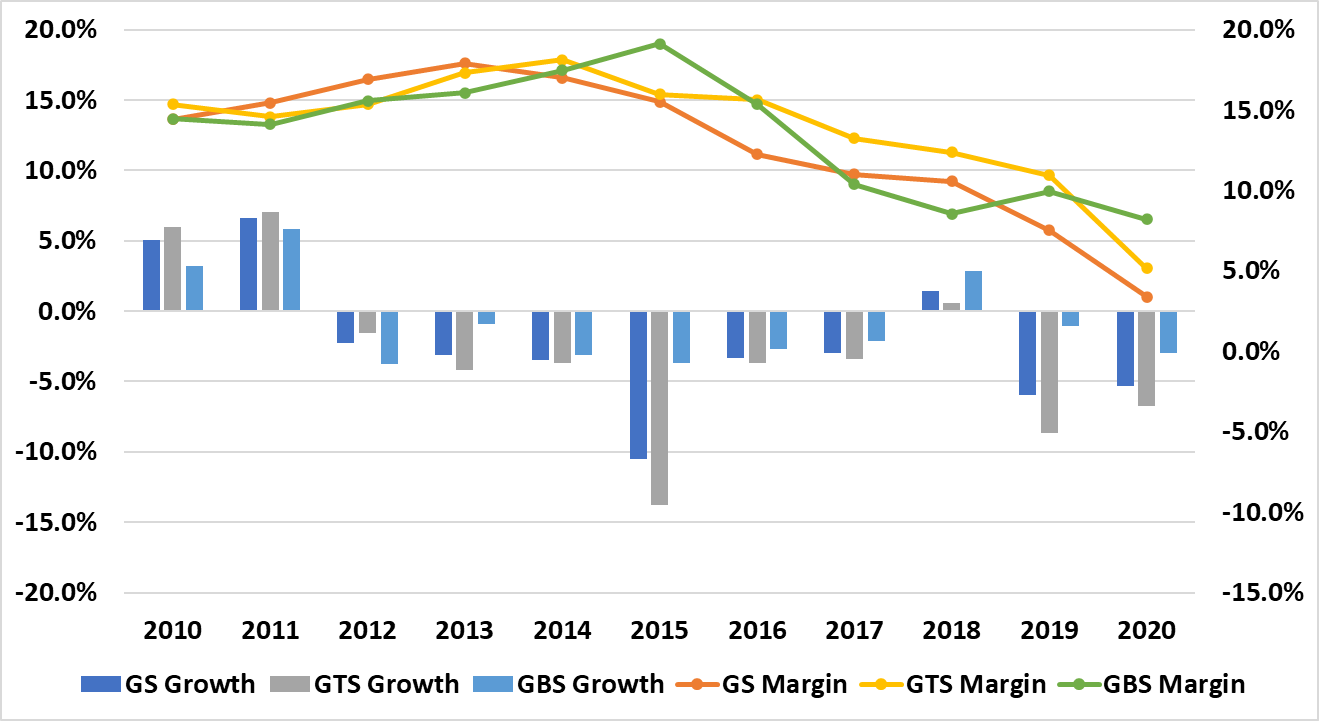

Exhibit 1 shows revenue growth and operating margin for IBM Global Services (IBM GS), IBM Global Technology Services (IBM GTS), and IBM Global Business Services (IBM GBS) since 2010.

Exhibit 1 – IBM Services Growth and Margin

Source: IBM financials (2020 growth is for H1)

As you can see from the chart, neither of IBM’s services business had been performing well since 2011. GTS and GBS growth were slowed by the shift to offshore labor and then by the move to cloud and more automated ways of delivering managed IT services. With all of its legacy outsourcing competitors, IBM struggled to show growth as its backlog of business restructured. Although we saw a glimmer of hope in 2018 as the volume of revenue from its new deals overtook the decline of its legacy deal base, the market continued to shift aggressively away from traditional managed services engagements toward cloud-based and automated approaches. IBM’s unique selling point in infrastructure management – its ability to take on the largest, most complex environments became less important. With the offshore providers – both the global majors like TCS, HCL, Infosys, Wipro, and Cognizant, and the mid-tier providers aggressively targeting its base. And much of the more complex decision-making is being driven by consulting – so digital and its implementation with cloud helped to drive IT Services spend from managed to professional services.

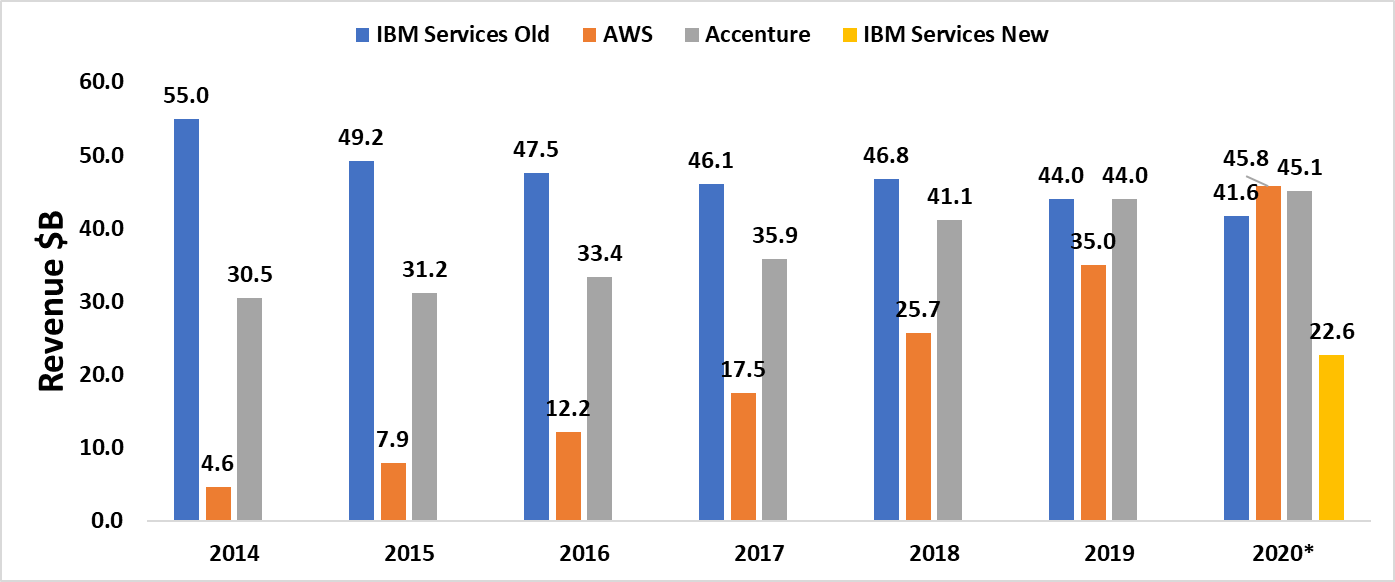

You can see the “cloud effect” and the shift toward professional services evident in Exhibit 2, which compares IBM GS revenues against AWS and Accenture over the past six years.

Exhibit 2 – IBM was already set to lose number 1 spot in 2020 to Accenture

Source: Company Financials *2020 estimated from H1 2020 performance. IBM would be the whole of IBM GS w/o divestiture

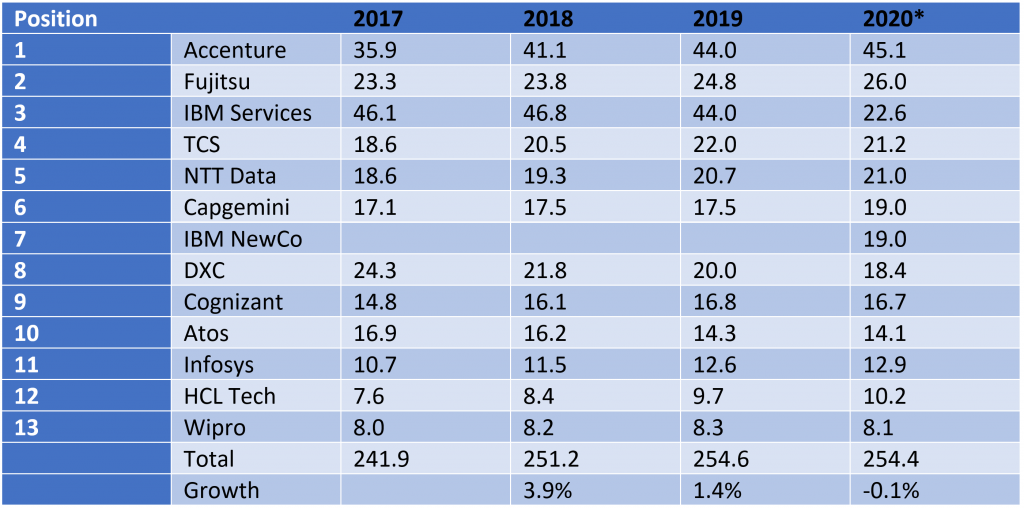

Exhibit shows that IBM was likely to be number 2 in IT Services revenue during 2020 regardless of the divestiture, with Accenture taking the top spot thanks to its ability to position itself as the master of transformation and re-platforming. We can see the wider impact of this on the IT services landscape in Exhibit 3. Exhibit 3 estimates the positioning of the leading global IT Services players by revenue for the last three years and provides an estimate for 2020 based on H1 performance.

Exhibit 3 – IT Services Leading Providers Revenue 2017 to 2020 in $B

Source: Company Financials *2020 estimated from H1 2020 performance so final 2020 revenues may change, particularly if the impact of COVID is less severe than feared. IBM Services Revenue is split between retained IBM and NewCo. The chart shows total revenues or total services revenues so it may include non-IT Services like BPO. Calendar year – quarterly revenue is allocated to the closest calendar year for comparison. This list consists of the leading global IT Service players, excluding pure consulting, specialist regional players like large US government contractors, and the pure BPO providers.

So does this mean IBM is no longer a services company? Will IBM create a big 4 cloud company to join the hyperscalers?

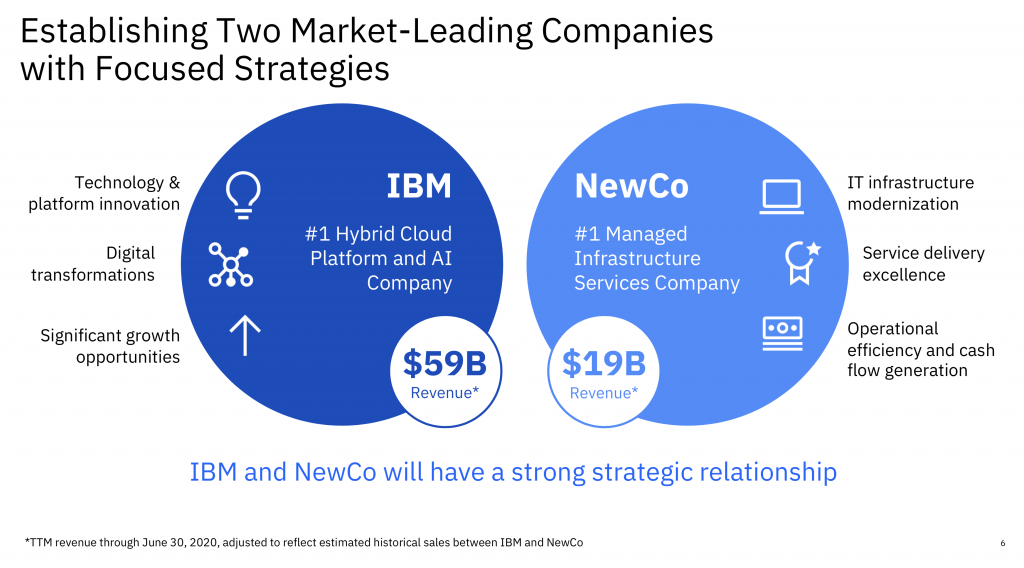

IBM state that the retained company will have TTM revenue to June 2020 of $59B – $23B of this revenue will be services, GBS and the part of GTS being retained. And it will still be the number 3 or number 4 services company globally, depending on the final performance of TCS in 2020 (see Exhibit 3).

However, IBM’s emphasis is shifting much more toward its software, hardware, and, ultimately, its cloud-delivered platforms. This is more in tune with the direction of the IT and IT Service market overall, providing customers with ways to utlise enabling disruptive technologies like machine learning, like AI and like hybrid cloud. It will also mean IBM will be a more viable technology partner for the global services companies. With the IBM cloud conversation within service companies always secondary to the AWS, Azure and Google conversation. This divestiture may help it to raise its profile as one of the big four cloud technology companies, and make it a viable partner in places it was less than welcome in the past.

The NewCo spin-off organization will have a difficult time establishing itself – we’ve seen similar organizations like DXC struggle despite strong managed services heritage from the old outsourcing masters CSC and HP ES (EDS) – just look at the revenue performance over the past 4 years in exhibit 3. However, this move probably gives it the best chance of success, with a free hand to partner more broadly with other key technology providers like Microsoft, Google, ServiceNow and AWS, without even the unconscious fear that you are dealing with a competitor.

Check out our recent blog on IBM’s quantum computing roadmap.